Robert Walters Global Jobs Index: October 2024

22 October 2024.

Global professional job roles decreased by -5% in September – in what is typically deemed one of the busiest months for recruitment according to new data.

- Professional roles decreased by -5% globally in September (vs previous month, August)

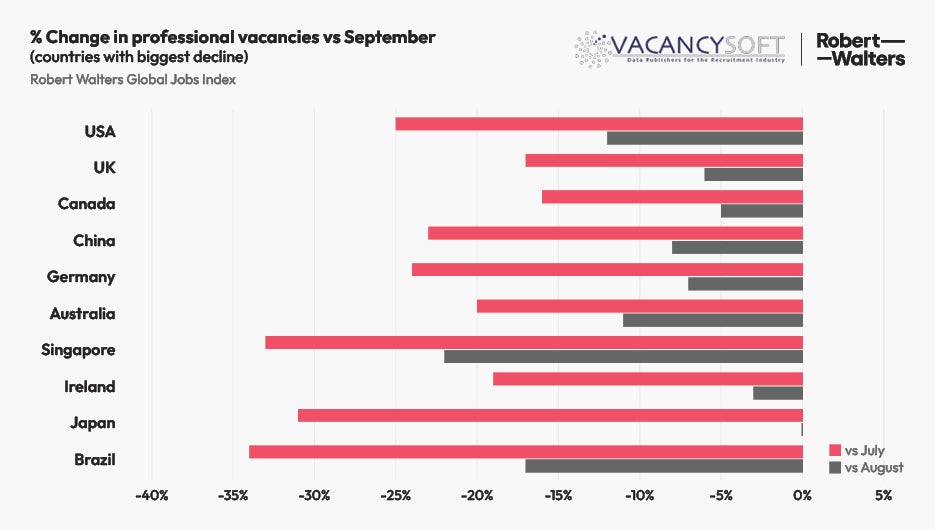

- USA, UK, Singapore, Germany, and Australia report biggest declines

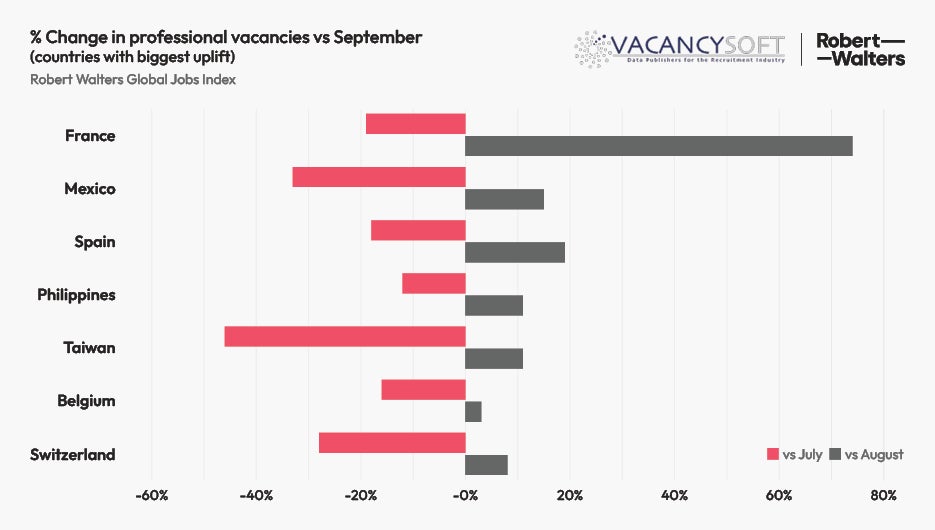

- Europe experienced traditional September ‘surge’

- Mexico and Philippines benefit from offshoring and creation of shared service centers

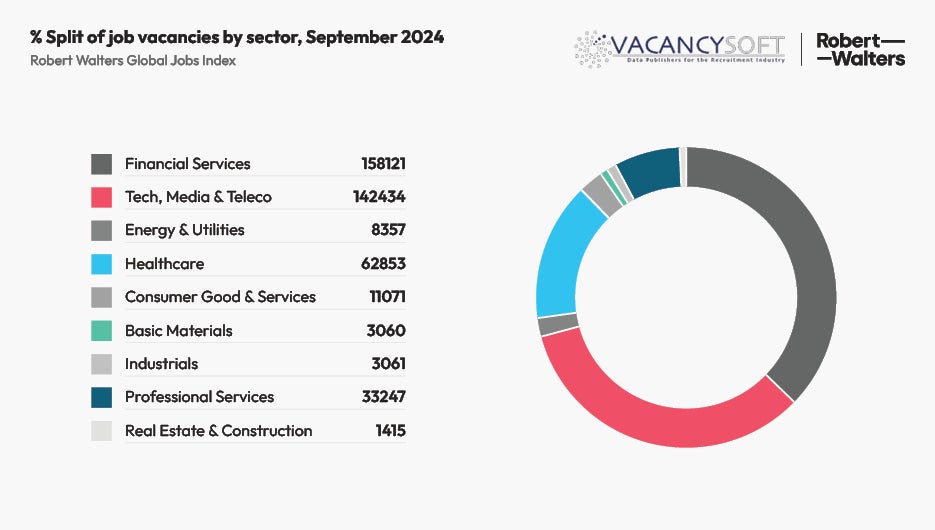

- Financial Services leads the way in job volume

- Professional Services reported a 17% increase in September

- Tech roles continue to decline month-on-month

The decline in white-collar job vacancies has raised concerns about the economic outlook in several countries – many of which were hoping for a stronger end to what has been a muted year for new job creation.

Among the countries experiencing the biggest decline in job roles in September compared to August were; Singapore (-21.81%), USA (-12.13%), Australia (-11.26%), Germany (-6.85%), and the UK (-5.62%).

Toby Fowlston, CEO of global talent solutions business Robert Walters, comments:

September's decline in professional job roles globally is a departure from the usual surge of hiring activity we expect at this time of year – and is a direct reflection of the geopolitical tensions, economic outlooks, and industry-specific issues on the global jobs market.

The findings come from the newly launched Robert Walters Global Jobs Index – released on Tuesday 22 October 2024 – and is the only index of its kind to track job flow for professionals across the globe by looking at external job adverts posted online in real time.

Fowlston analyses why certain countries didn’t see the expected job increases in September:

- “In the USA, the upcoming election and potential policy shifts have resulted in employers holding off on hiring."

- “The UK is experiencing increased uncertainty as businesses hold back on hiring in anticipation of the government's budget announcement."

- “Germany's economic weakness, geopolitical tensions, and job cuts in the automotive sector have contributed to companies being more cautious about hiring."

- “In Australia, the cautious economic outlook, inflation, and interest rates have led to a decrease in hiring, particularly in sectors impacted by cuts to international student numbers."

- “Meanwhile, Singapore's job flow is slowly picking up, and the decline in September may not be a fair indicator due to rushed offers and vacancies closed in August.”

Europe benefits from September ‘Surge’

The data revealed some positive trends in Europe with France (+74.4%), Spain (+18.66%), Switzerland (7.58%), and Belgium (+2.65%) experiencing the traditional 'September Surge' in job vacancies.

Toby Fowlston: “The combination of a post-Summer and post-Olympics rebound for France resulted in a positive uplift in professional job vacancies. Whilst Spain experienced the traditional September uplift’ this was generally more muted than previous years. An overall decline in consumption had a notable impact on retail, industry, and manufacturing – however tourism and leisure continued to lead the way in job creation.

“Belgium and Switzerland can attribute the rise in jobs to the post-summer ‘pick-up’ of businesses, with the relaunch of certain projects driving job flow and internal moves.”

Cost cuts benefitting other countries

Meanwhile, countries benefitting from firms’ cost-saving tactics - such as offshoring - included Mexico (+15.06%), Philippines (+6.47%), and Taiwan (+5.81%).

Toby Fowlston: “Mexico and the Philippines have benefitted greatly as offshore hubs – or from businesses locating their shared service or global business services (GBS) centres there. Whereas Taiwan has seen an increase in jobs due to their positioning in the tech supply chain, or contract manufacturing.”

Sectors in demand

The Financial Services industry remains the largest industry grouping for white-collar job creation, accounting for 37% of all roles posted globally in September - followed by the Tech, Media & Teleco industry (32%).

Whilst USA leads the way in overall volume of jobs posted online, Australia and Canada were the only countries out of the top 10 where job vacancies in September exceeded what they posted in July (+4%).

Nonetheless for financial services, Q3 2024 is set to be the best business quarter for vacancies since Q3 2022. Vacancies in Q3 are 19% higher than Q2.

Toby Fowlston: “We are starting to see the financial services market pick up, which is often the case as interest rates begin to come down – encouraging more deal flow and investments.”

Professional Services – which includes the Big 4 – although a small contributor to jobs in comparison to Financial Services and Tech, Media & Teleco, saw a 17.4% increase in job vacancies in September (vs August).

The most in-demand roles from professional services firms continue to be for tech talent, accountants, and consultants – with jobs on track to be +15%, +12% and +8% higher than the previous year if the same momentum continues.

Toby Fowlston: "There could be a variety of reasons why professional services firms are ramping up their hiring – for example if we are expecting to see a big divestment from venture capital firms then it would only make sense for accounting and consultancy firms to be scaling up their teams involved in IPOs. “Let’s not forget that this year saw some of the Big 4 fined over audit failures – and so it comes as no surprise to see firms ramp up their staff numbers in the lead-up to the busy audit season.”

Tech still down

Tech, Media & Teleco (TMT) face downward pressure, with the top 10 countries posting less job vacancies in September vs August (and July).

Singapore (-26%), Germany (-20%), USA (-19%), and Australia (-17%), all reported a notable drop in job volumes in September vs August.

Toby Fowlston: “With macro factors at play – including rising business costs and fluctuating interest rates – this has resulted in businesses buying or investing less in their tech products, platforms, or system features. In turn, tech companies are trying to offset this decline in demand by laying-off staff or freezing headcount or projects.

“In addition, tech companies in particular were notorious for ‘over hiring’ during and directly after the pandemic as a result of an unprecedented increase in demand, and so the month-on-month decline could be due to correction and streamlining of costs which has been an ongoing process this year.

“It’s also important to note that tech companies have felt the biggest impact from the reduction in venture capital funding and tighter financial controls.”

Mexico (+14.55%), China (+14.22%), and India (+4.31%) are the only countries to report more job vacancies across the Tech, Media & Teleco sector in September vs the previous month.

In conclusion, Fowlston notes: "While we are seeing a decline in job volumes in some countries and industries, it's important to remember that the global job market is always in flux. As a number of geo-political factors settle in the last quarter – including the US election and interest rates around the globe – we can expect to see an evolution of some of these trends.

The Robert Walters Global Jobs Index – delivered in conjunction with Vacancysoft - was released on Tuesday 22 October 2024, with the next Index due for release on Tuesday 19 November 2024.

The Index analyses job adverts posted on the websites of the large organisations around the globe.

For media enquiries, contact:

Rum Gill

PR Manager

Robert Walters

E: rumandeep.gill@robertwalters.com

T: 020 7509 8178

.png)