Robert Walters Global Jobs Index: April 2025

22 April 2025.

March Sees Global Uptick in Professional Job Growth, but future impact of US trade tariffs remains to be seen

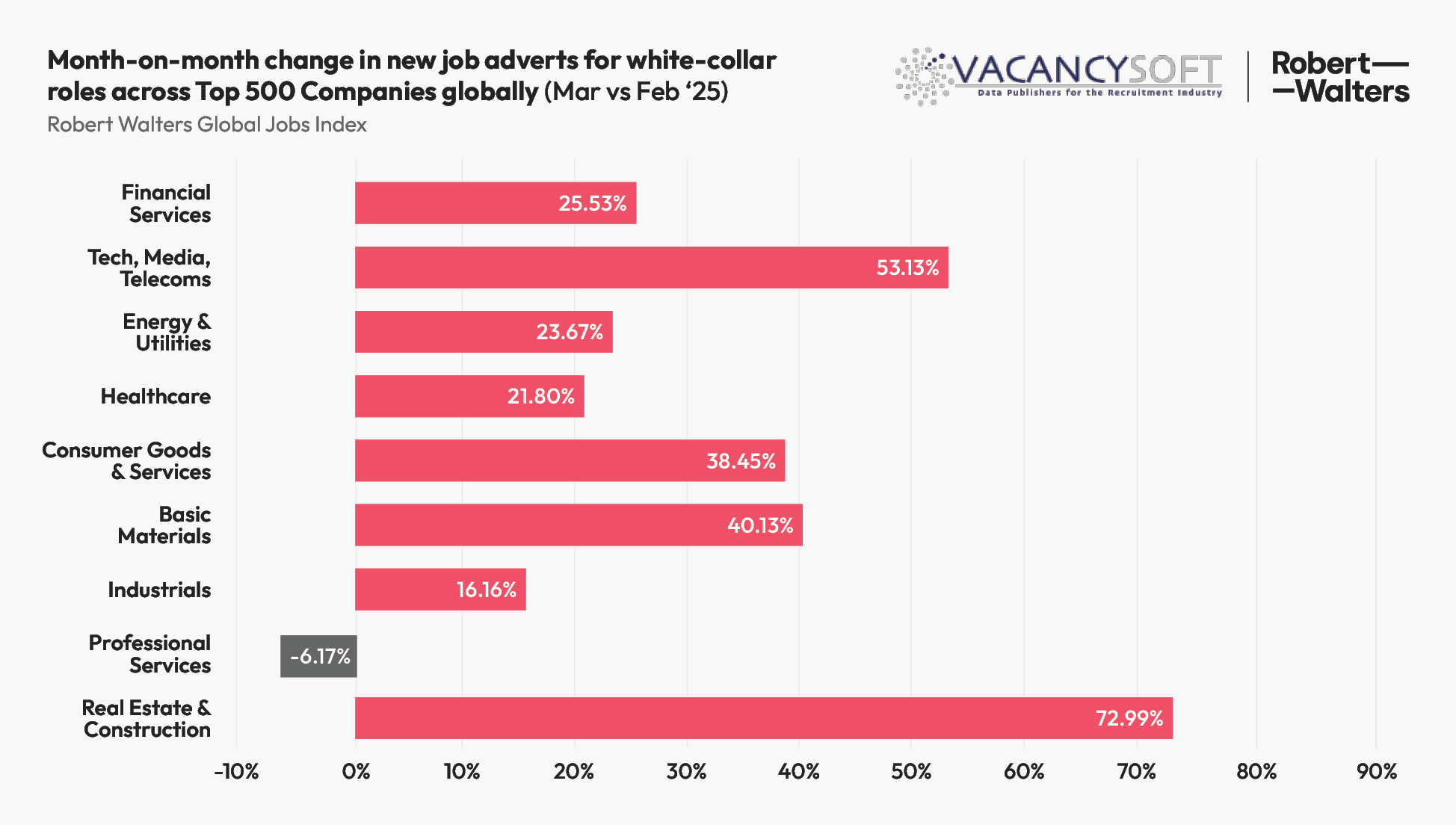

Global white-collar vacancies jump +31% in March 2025 compared to February 2025 across all industries following a month-on-month decline in February

USA sees +38% rise in vacancies in March vs February 2025 - Tech, Media & Telecoms: +59.36%, Industrial: +49.51% and Consumer Goods & Services: +30.9%

Tech, Media & Telecoms reclaims top spot in global vacancies – up +53% month-on-month in March compared to February

Financial Services vacancies see global increase of +23.5% month-on-month, with significant increases in the USA, Australia, and India

Global hiring activity increased in March, with vacancies up +31% compared to February 2025. This sharp rise rounds off a solid first quarter, with total Q1 vacancies +15.2% up versus Q4 2024 levels. However, the future impact of US tariffs remains to be seen.

Growth was recorded across all of the top ten hiring countries, with the USA (+38.45%), India (+14.70%) and Canada (+18.52%) leading the way. The UK (11.07%) and Poland (+8.85%) saw the biggest increase across Europe.

New data from the Robert Walters Global Jobs Index – published today, Tuesday, 22 April 2025, in conjunction with Vacancysoft – highlights the shifting dynamics in job creation across industries and geographies.

Toby Fowlston, CEO of global talent solutions business Robert Walters, comments: “Employers have started the year with a greater sense of direction around headcount planning. Hiring momentum began to build in some locations in March but it’s difficult to predict the same growth rates in April due to the evolving impact of US trade policies.”

USA drives global growth – but policy uncertainty looms

Overall, U.S. job postings rose by +38.45% month-on-month in March – one of the sharpest increases globally. Top sectors that contributed to this growth were Tech, Media & Telecoms, which grew by 59.36%, Industrial sectors, up by 49.51%, Consumer Goods & Services, which saw a 30.9% increase, and Financial Services, which rose by 28.85%.

Toby adds: "The U.S. figures for March are notably strong, reflecting a sharp increase in hiring across several key sectors. However, it’s important to recognise that this growth occurred prior to the implementation of the latest round of tariffs. The introduction of new trade deals in early April could influence business confidence, particularly in export-driven industries."

“That said, domestic-facing industries and companies less affected by trade shifts may continue to hire steadily, helping to offset potential softness elsewhere. Much will depend on how quickly businesses adapt to the new trade environment and identify new opportunities for growth.”

Tech, Media & Telecoms Reclaims Top Spot Globally

The Tech, Media & Telecoms sector saw the largest monthly growth in vacancies across all industries, rising by 53.1% compared to February. Key markets driving this growth included Poland (+140.69%) and Mexico (+25.27%).

Germany saw an increase of 24.15%, driven largely by a growing demand for roles in software development, artificial intelligence, cloud computing, and IT project management.

“There’s a renewed appetite for digital talent around the world, particularly in areas such as artificial intelligence, data science, and cybersecurity,” comments Toby. “After a quieter start to the year, we are seeing some businesses resume transformation projects. However, this growth is more strategic and targeted, rather than a return to the broader expansion seen in 2022.”

Growth in Financial Services Sector Continues

The Financial Services sector experienced a global increase of 23.5% in March, with notable growth in key markets such as the U.S. (+28.85%) and India (+22.58%).

In Australia, recent regulatory changes have driven demand for professionals across compliance and risk functions. This, coupled with ongoing investment in technology aimed at improving customer experience and operational efficiency, has contributed to a sharp increase in vacancies (+34%).

Toby adds: “The increase in Financial Services vacancies reflects sustained demand for talent in critical areas such as risk management, compliance, and treasury management. While March figures are positive, we will continue to monitor how evolving market conditions and potential changes in the regulatory environment may influence hiring trends in the months ahead.”

For Media Enquiries

Carmen Walker

PR Manager

E: Carmen.walker@robertwalters.com

T: 020 7509 8481

.png)