Robert Walters Global Jobs Index: January 2025

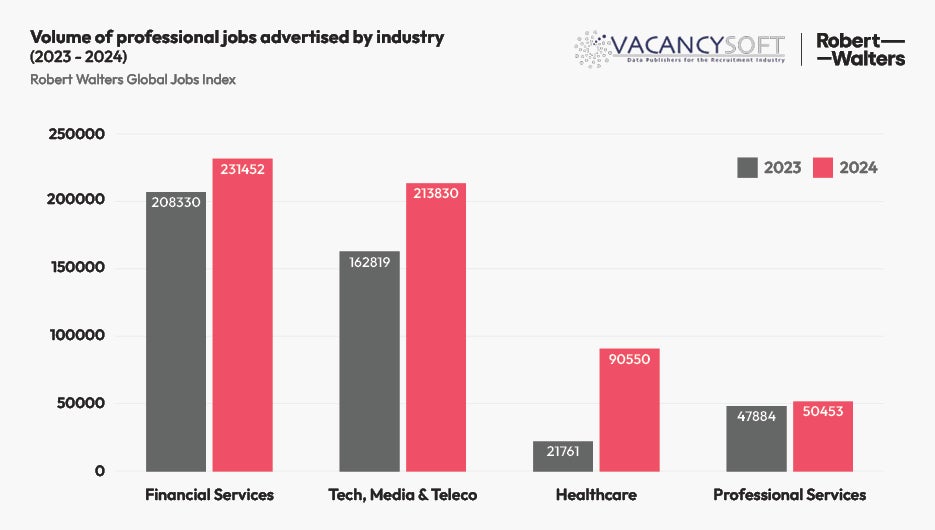

- Financial services vacancies increase globally by +11% in 2024 (vs previous year)

- Technology, media and telecoms (TMT) globally saw an uplift in vacancies of +25% in 2024 (vs previous year).

- Professional services has had the smallest quarterly drop across the major industries (Q4 vs Q3) - and in terms of annual activity, has had an increase of +5.37% compared to 2023.

- Sectors/Roles to watch in 2025: energy, cybersecurity, and transformation.

2024 presented a mixed bag for global recruitment, with select sectors such as financial services, technology, and professional services delivering pockets of growth amid an otherwise uneven landscape.

New data from the Robert Walters Global Jobs Index – published today, Tuesday 21 January 2025 in conjunction with Vacancysoft - highlights the shifting dynamics in job creation across industries and geographies, with the final months of the year dampened by economic and political uncertainty and seasonal hiring trends.

Financial services sees a modest revival

Vacancies in financial services grew by +11% globally in 2024 compared to the previous year. The US led the charge with a +7% year-on-year increase, while Europe lagged behind, with notable declines in the UK (-11%), France (-11%), and Germany (-19%).

Toby Fowlston, CEO of Robert Walters, comments: "Financial services showed resilience in the past 12 months, particularly in the US, where economic recovery and deal activity gained traction.

However, Europe’s economic uncertainty - driven by inflation and geopolitical tensions - has restrained job growth. With a changing regulatory landscape, we anticipate an uptick in hires around risk and compliance in the first quarter of this year.

Tech leads growth but faced Q4 decline

The technology, media and telecommunications (TMT) sector saw a +25% rise in job vacancies globally in 2024 (vs 2023). In the UK, one of the stronger performing markets in this sector, roles increased by +12.3% year-on-year.

However, global hiring slowed in Q4, with an -11% decline compared to the previous quarter, reflecting a cautious investment environment.

Toby adds: “Interest rate reductions in some regions earlier in the year drove much of the growth in tech hiring. But Q4 has exposed the vulnerabilities of the sector, with investment slowing and businesses tightening budgets amid macroeconomic pressures.”

Healthcare and professional services deliver stability

Healthcare recorded a modest global uplift of +3% (2024 vs 2023), driven by a +4.7% year-on-year increase in the US and a striking +50% rise in India - a market to watch closely.

Spain also stood out within Europe, with healthcare job growth surging by +22.5%. In contrast, China saw a -16% drop in hiring activity.

Professional services demonstrated resilience, with a +5.37% year-on-year increase in vacancies (2024 vs 2023) despite a -11% drop in Q4 (vs Q3).

Fowlston added: “Professional services firms have adapted well, with agile business models supporting job creation even in turbulent markets. This sector will be crucial as companies navigate compliance, sustainability mandates and cost optimisation efforts in 2025.”

‘Damp squib’ of a December

December hiring volumes fell sharply by -34% compared to November, as businesses paused recruitment activities ahead of the holiday season. This contributed to a -17.9% quarterly decline in Q4 hiring overall.

What to expect in 2025: Sectors to watch

As the global job market looks ahead, certain industries are primed for growth:

- Energy: The US could lead an energy recruitment boom in 2025, particularly if policy shifts under Trump’s administration favour new drilling projects.

- Cybersecurity: Regulatory changes and the evolving threat of AI-driven attacks will drive demand for cybersecurity professionals globally.

- Transformation roles: Both finance and technology sectors will seek transformation experts to enhance operational efficiency and cost optimisation.

Fowlston concluded: “2024 may have closed on a muted note, but we are hopeful to see a more dynamic 2025. Industries driving innovation, transformation and sustainability will define the next wave of job creation.”

The Robert Walters Global Jobs Index – delivered in conjunction with Vacancysoft - was released on Tuesday 21 January 2025, with the next Index due for release on Tuesday 18 February 2025.

The Index analyses job adverts posted on the websites of the largest organisations around the globe.

For further information and media inquiries, please contact:

Rum Gill

PR Manager

E: ruman.gill@robertwalters.com

T: 020 7509 8178

M: 07827 251 971

.png)